Follow Our Sellers Checklist To Stay Safe While Selling Your Home

Staying organized while uprooting your life and moving from one home to another can feel impossible. Not only are you trying to get the best financial return on your investment, but you might also be working on a tight deadline. There’s also the pressure to keep your home clean and organized at all times for prospective buyers. However, one thing you can be sure of when selling your home is that there will be strangers entering your space, so it’s important for you and your agent to take certain safety precautions.

Like so many things in life, they can feel more manageable once written down, so we made this handy checklist.

- Go through your medicine cabinets and remove all prescription medications.

- Remove or lock up precious belongings and personal information. You will want to store your jewelry, family heirlooms, and personal/financial information in a secure location to keep them from getting misplaced or stolen.

- Remove family photos. We recommend removing your family photos during the staging process so potential buyers can see themselves living in the home. It’s also a good way to protect your privacy.

- Check your windows and doors for secure closings before and after showings. If someone is looking to get back into your home following a showing or an open house, they will look for weak locks or they might unlock a window or door.

- Consider extra security measures such as an alarm system or other monitoring tools like cameras.

- Don’t show your own home! If someone you don’t know walks up to your home asking for a showing, don’t let them in. You want to have an agent present to show your home at all times. Agents should have screening precautions to keep you and them safe from potential danger.

Talk to your agent about the following safety precautions:

- Do a walk-through with your agent to make sure you have identified everything that needs to be removed or secured, such as medications, belongings, and photos.

- Go over your agent’s screening process:

- Phone screening prior to showing the home

- Process for identifying and qualifying buyers for showings

- Their personal safety during showings and open houses

- Lockboxes to secure your keys for showings should be up to date. Electronic lockboxes actually track who has had access to your home.

- Work with your agent on an open house checklist:

- Do they collect contact information of everyone entering the home?

- Do they work with a partner to ensure their personal safety?

- Go through your home’s entrances and exits and share important household information so your agent can advise how to secure your property while it’s on the market.

By Kenady Swan, Windermere

Planning for the Life Expectancy of Your Home

Nothing in life lasts forever – and the same can be said for your home. From the roof to the furnace, every component of your home has a lifespan, so it’s a good idea to know approximately how many years of service you can expect from them. This information can help when buying or selling your home, budgeting for improvements, and deciding between repairing or replacing when problems arise.

According to a National Association of Home Builders (NAHB) study, the average life expectancy of some home components has decreased over the past few decades. (This might explain why you’re on your third washing machine while Grandma still has the same indestructible model you remember from childhood.) But the good news is the lifespan of many other items has actually increased in recent years.

Here’s a look at the average life spans of some common home components (courtesy of NAHB).

Appliances. Of all home components, appliances have the widest variation in life spans. These are averages for all brands and models and may represent the point which replacing is more cost-effective than repairing. Among major appliances, gas ranges have the longest life expectancy, at about 15 years. Electric ranges, standard-size refrigerators, and clothes dryers last about 13 years, while garbage disposals grind away for about 10 years. Dishwashers, microwave ovens, and mini-refrigerators can all be expected to last about nine years. For furnaces, expect a lifespan of about 15 years for electric, 18 for gas, and 20 for oil-burning models. Central air-conditioning systems generally beat the heat for 10 to 15 years.

Kitchen & Bath. Countertops of wood, tile, and natural stone will last a lifetime, while cultured marble will last about 20 years. The lifespan of laminate countertops depends greatly on the use and can be 20 years or longer. Kitchen faucets generally last about 15 years. An enamel-coated steel sink will last five to 10 years; stainless will last at least 30 years; and slate, granite, soapstone, and copper should endure 100 years or longer. Toilets, on average, can serve at least 50 years (parts such as the flush assembly and seat will likely need replacing), and bathroom faucets tend to last about 20 years.

Flooring. Natural flooring materials provide longevity as well as beauty: Wood, marble, slate, and granite should all last 100 years or longer, and tile, 74 to 100 years. Laminate products will survive 15 to 25 years, linoleum about 25 years, and vinyl should endure for about 50 years. Carpet will last eight to 10 years on average, depending on use and maintenance.

Siding, Roofing, Windows. Brick siding normally lasts 100 years or longer, aluminum siding about 80 years, and stucco about 25 years. The lifespan of wood siding varies dramatically – anywhere from 10 to 100 years – depending on the climate and level of maintenance. For roofs, slate or tile will last about 50 years, wood shingles can endure 25 to 30 years, the metal will last about 25 years, and asphalts got you covered for about 20 years. Unclad wood windows will last 30 years or longer, aluminum will last 15 to 20 years, and vinyl windows should keep their seals for 15 to 20 years.

Of course, none of these averages matter if you have a roof that was improperly installed or a dishwasher that was a lemon right off the assembly line. In these cases, early replacement may be the best choice. Conversely, many household components will last longer than you need them to, as we often replace fully functional items for cosmetic reasons, out of a desire for more modern features, or as a part of a quest to be more energy efficient.

Are extended warranties warranted?

Extended warranties, also known as service contracts or service agreements, are sold for all types of household items, from appliances to electronics. They cover service calls and repairs for a specified time beyond the manufacturer’s standard warranty. Essentially, warranty providers (manufacturers, retailers, and outside companies) are betting that a product will be problem-free in the first years of operation, while the consumer who purchases a warranty is betting against reliability.

Warranty providers make a lot of money on extended warranties, and Consumers Union, which publishes Consumer Reports, advises against purchasing them. You will have to consider whether the cost is worth it to you; for some, it brings a much-needed peace of mind when making such a large purchase. Also, consider if it the cost outweighs the value of the item; in some cases, it may be less expensive to just replace a broken appliance than pay for insurance or a warranty.

The Do’s and Don’ts of Hiring a Contractor

Constructing or remodeling a home is a complex, expensive endeavor. Ideally, everything goes as planned, and when the dust clears, the homeowner can settle in and enjoy the new home — and never think about the building process again.

But what happens when, nine months after the owner moves in, the floor develops a crack, the dishwasher begins to leak or the shower water won’t run hot? Or when these things happen three years later? It’s time to refer to an all-important piece of the contract: the warranty.

What Is a Warranty?

The purpose of a warranty is to protect both the homeowner and the builder — homeowners from shoddy work with no recourse; builders from being liable for projects for the rest of their lives.

A warranty may be included in a contract, or it may not be since it’s not required. There is no standard length of time for one. Rather, a warranty is a negotiable portion of the overall agreement (contract) between a homeowner and a contractor.

The laws that relate to warranties are somewhat vague and vary by state, so the advantage of having one as part of the contract is that everything can be clearly spelled out. However, by agreeing to a particular warranty without understanding its finer points, owners may inadvertently limit the protections they would have otherwise had under the law.

“A warranty describes the problems and remedies for which the builder will be responsible after completion of the project, as well as the duration of the warranty and the mechanism for addressing disputes,” says David Jaffe, vice president of legal advocacy at the National Association of Home Builders.

At least in the ideal case.

The Law Governing Warranties

Before homeowners agree to a particular warranty as part of their contract, it’s important to understand what protections they already have under the law. In the U.S., we have a legal concept of an implied warranty — which is a warranty that does not have to be spelled out in the contract but is simply understood to exist thanks to the law. There are two important implied warranties when it comes to home construction.

The first is the implied warranty of good workmanship, which is the reasonable expectation that a home will be built in a workmanlike manner. The second is the implied warranty of habitability, which is the reasonable expectation that the home will be safe to inhabit.

The implied warranties, however, have limits in the form of statutes of limitation and statutes of repose, which essentially are time clocks that determine for how long a homeowner may sue a contractor.

Statutes of limitation in each state dictate how long an owner can invoke various types of legal claims — for example, a breach of contract claim.

Statutes of repose apply specifically to construction projects and set the time for which builders and designers are liable for their product. These also vary by state. In California, the statute of repose is four years for most defects, but 10 years for latent defects (those that aren’t observable right away, such as a faulty foundation). In Georgia, the statute of repose is eight years for all claims related to the design or construction of the building.

Finally, most states also have a right to repair law, which means that before homeowners can sue a contractor, they need to notify the contractor of the problem and give him or her a chance to come to see it and repair it.

To find out what the laws are in your state, simply do an online search for “statute of repose” and “right to repair” in your state.

The One-Year Warranty

The key thing to understand about warranties is that many builders offer their own warranty in lieu of the implied warranty. Additionally, many contracts specify that homeowners are giving up their rights to the implied warranty by agreeing to the builder’s express warranty. Also, builders will “often try to shorten statutes of limitation and statutes of repose. Some states allow you to do that. Others don’t,” says Anthony Lehman, an Atlanta attorney who advises homeowners.

Though there is no industry-wide standard, many residential contractors have adopted a one-year warranty for their contracts. The practice likely trickled down from commercial construction, where a callback warranty is typical. A callback warranty means that within one year, a building owner has the right to call back the contractor and expect him or her to repair work, Lehman says.

The downside for homeowners who agree to a one-year warranty is that they likely trade away their right to the implied warranty, and they may also agree to limit the time they have to discover a defect and sue. Obviously, this is a plus for builders because it limits their risk.

But there is no real reason a homeowner has to accept a one-year warranty simply because that’s the builder’s first offer. “It’s a negotiated point, and people can negotiate warranties that are broader — and they often do,” says Robert C. Procter, outside general counsel for the Wisconsin Builders Association. “If you don’t ask for more, you won’t get more.”

Pros and Cons of a Builder’s Warranty

Though a one-year warranty may seem like a poor deal for a homeowner, a contract with details spelled out does provide an upside: some degree of clarity in the process. Ideally, a warranty includes not only the time period that the warranty covers, but also the standards by which various materials will be evaluated, and the steps to follow when a problem arises.

In a minority of states, the legislature has codified what a warranty is and how long it lasts for a variety of materials, Jaffe says. They are California, Connecticut, Indiana, Louisiana, Maine, Maryland, Minnesota, Mississippi, New Jersey, New York, Pennsylvania, Texas, and Virginia. If you live in one of these states, you can refer to the state-set standards.

If you do not, one option is to refer to the NAHB’s publication Residential Construction Performance Guidelines. “It’s broken down by categories within the home: foundations, exterior, interior, roofing, plumbing,” Jaffe says. “If there’s an issue that comes up, you look in this publication, and it tells you what the observation is — what’s the problem.” The guide then spells out what the corrective measure — if any — should be.

If you decide to use this guide as the standards by which problems will be judged, be sure you read it first and are comfortable with its terms. Sometimes having the terms spelled out is simpler than relying on the implied warranty because the implied warranty is so vague.

“The implied warranty doesn’t have a fixed time; it’s a reasonable period of time,” says Jaffe, of the NAHB. “If you’re a homeowner, and you call your builder up in year five and say, ‘There’s a crack here, and I think you should come out and fix it because it’s a defect,’ well, at that point, it may or may not be related to something that the builder did or didn’t do. Is it a defect? Who is going to make that determination? What is the fix? Who is responsible for it?”

Relying on the implied warranty means that these sorts of questions would need to be resolved in court if the parties aren’t willing to, or can’t, come to an agreement on their own. Open for debate is whether an item is a warranty item, and for how long it’s covered. Having these issues determined in court can be an expensive, time-consuming headache for everyone involved.

Still, some attorneys say owners might be better off with the implied warranty than giving up their rights for a limited one provided by the builder. “You build a house, and you expect it to be there for a long time. The buildings in Europe have been there a long time. The pyramids have been there a long time. The question is how long is it reasonable for you to expect it to last,” says Susan Linden McGreevy, an attorney in Kansas City, Kansas, who specializes in commercial real estate work. “If it has to get before a jury, the contractor has lost already. What I mean is, the jury will always find in favor of a homeowner — unless they’re a real flake.”

Going Beyond Warranties

Despite all this talk of legalities, there is an important caveat: Many good builders will continue to be helpful even after their express warranty has passed. Anne Higuera, co-owner of Ventana Construction in Seattle, provides a one-year warranty to her clients. Nonetheless, Ventana has made repairs and fixes even years after the one-year warranty expired. Higuera says the company does so because the builders want good relationships with their customers, and because they feel as though it’s the right thing to do. “Warranty issues come up very rarely if you do things well in the first place,” Higuera says. “Just finding a contractor who does the right thing on the front end helps you avoid issues with warranty.”

More Ways to Protect Yourself

So what should homeowners do if a builder is offering only a one-year warranty? One option is to negotiate for a longer period of time. “You might want to say, ‘I’ll take a one-year warranty for everything except latent defects,’” McGreevey says. (Reminder: Those are the kind that take a long time to discover, such as foundation problems.)

Another option owners have is to ask builders about insurance products. Many builders offer products with an extended warranty — as long as 10 years — that is backed by insurance companies. These are typically paid for by the builder, with the cost passed on to the homeowner.

Third, homeowners would be wise to consult an attorney to make sure that they’re not giving up rights unknowingly. Given that owners are spending thousands to hundreds of thousands of dollars on construction, paying for five to 10 hours of an attorney’s time (at $300 per hour, $1,500 to $3,000) to ensure that the contract is sound is probably a good investment. “Would you buy a car for $50,000 and not read any of the financing information?” says Lehman, the Atlanta attorney. “And then people do that for a home construction project.”

Finally, the most important thing is for both contractors and owners to screen each other carefully. “Ninety-eight percent of the homeowner-builder relationships, when there’s a disagreement, most parties reach a reasonable conclusion, even if they’re not 100 percent happy,” says Procter, the Wisconsin attorney. “The contracts matter more when someone is not being reasonable.”

10 Tips to Minimize Stress When Selling Your Home

When I was growing up, my family must have moved a dozen times. After the first few moves, we had it down to a science: timed out, scheduled, down to the last box. Despite our best efforts, plans would change, move-out and move-in days would shift, and the experience would stress the entire family out. Despite the stress, we always managed to settle in our new home and sell our old one before the start of school.

With a lot of planning and scheduling, you can minimize the stress of selling your house and moving. Here are some tips:

Plan Ahead

Know when you want to be moved out and into your new home and have a backup plan in case it falls through. Before you sell your home, familiarize yourself with local and state laws about selling a home so you’re not caught by surprise if you forget something important.

Lists and schedules are going to be your new best friend through the process. Have a timetable for when you want to sell your house when you have appraisers, realtors, movers, etc. over. Also, keep one for when your things need to be packed and when you need to be moved into the new place. I suggest keeping it on an Excel sheet so you can easily update it as the timeline changes (and it will – stuff happens).

Use Resources

First time selling a house? Check out some great resources on what you need to know. US News has excellent, step-by-step guides on what you need to know to sell. Appraisers and realtors can also be good resources, and since you’ll be working with them through the process, be sure to ask them questions or have them point you to resources.

Appraisal

Have your house appraised before you sell so you know your budget for your new home. This will help you look for an affordable home that meets your family’s needs. It will also help you maximize the amount you can receive for your old home. You can also learn useful information from an appraisal, such as which repairs need to be made, if any.

Repairs

Does your house need repairs before you move? If so, figure out whether you’ll be covering them, or whether your buyers will (this will be a part of price negotiations, so factor it in with your home budget). Will you need to make repairs in your new house, or will that be covered? Either way, make sure you know which repairs need to be made – and either be upfront with buyers about them or make them before you sell.

Prepare to Move

If you’re moving to a new town or a new state, you need to prepare more than just a new home. Research doctors and dentists, places to eat, and what to do for fun. If you have school-aged children, look at the local school district or private school options – not only to learn how to enroll your kids, but also to get a feel for the school culture, see what extracurricular activities your kids can do, what standards/learning methods your kids’ new school will implement, etc.

Packing

Think: how soon are you moving, what will you need to use before you move, what can get boxed and what needs to stay out? The sooner you’re moving out, the sooner you need to pack, but if you have time, just take a day per weekend to organize a room, pack what you want to take and arrange to donate what you want to get rid of.

Downsizing

Moves are a great time to purge old, unwanted and unused stuff from your home. Sometimes, it’s necessary if you’re moving into a smaller space. Either way, as you pack each room, think about whether you use what you’re packing to take with you. If you do, pack it to go. If not, put it in a separate box to go to your local donations place. You can also call some organizations to have your unwanted things picked up, no hassle.

If You Have Kids

Moving with kids can be extra stressful. Be sure to include them in the process. This is a wonderful opportunity to teach younger children about moving and prepare them for the changes it brings. Older children can help out with responsibilities, like packing their room or researching their new town.

Your New Place

Moving into a new place takes some planning as well. Once you’ve bought your new home or condo, design at least a basic outline for where your stuff will be set up. Make necessary repairs and decorate (painting, for example) before you unpack. Ideally, you should have some time to do these things before, but if you don’t, don’t be in a hurry to unpack everything – it can be a hassle to paint if you have all your furniture and bookshelves up!

Staying In Touch and Making New Friends

Finally, moving can mean good-byes with family and/or friends. Social media is a great way to keep in touch with people after you’ve moved, but distance can still weaken these old relationships. Make some time to call or message your old friends to keep in touch. Pair that work with a concerted effort to meet new people. See what hobbies or groups are in your new area and start there. It doesn’t seem like a lot, but it can make your new house a home and make your new town a community you can enjoy.

Investing In a Green Home Will Pay Dividends In 2019

As we step forward into 2019, eco-friendly “green homes” are more popular than ever. Upgrading your home’s sustainability improves quality of life for those residing in it, but it is also a savvy long-term investment. As green homes become more popular, properties boasting sustainable features have become increasingly desirable targets for homebuyers. Whether designing a new home from scratch or preparing your current home for sale, accentuating a house with environmentally-friendly features can pay big dividends for everyone.

While the added value depends on the location of the home, its age, and whether it’s certified or not, three separate studies all found that newly constructed, Energy Star, or LEED-certified homes typically sell for about nine percent more than comparable, non-certified new homes. Plus, one of those studies discovered that existing homes retrofitted with green technologies, and certified as such, can command a whopping 30-percent sales-price boost.

There are dozens of eco-friendly features that can provide extra value for you as a seller. To name a few:

Cool roof

Cool roofs keep the houses they’re covering as much as 50 to 60 degrees cooler by reflecting the heat of the sun away from the interior, allowing the occupants to stay cooler and save on air-conditioning costs. The most common form is metal roofing. Other options include roof membranes and reflective asphalt shingles.

Fuel cells

Fuel cells may soon offer an all-new source of electricity that would allow you to completely disconnect your home from all other sources of electricity. About the size of a dishwasher, a fuel cell connects to your home’s natural gas line and electrochemically converts methane to electricity. One unit would pack more than enough energy to power your whole home.

For many years, fuel cells have been far too expensive or unreliable. But as technology has improved, so too has reliability. Companies like Home Power Solutions and Redbox Power Systems have increased the reliability of these fuel sources while reducing their size. Much like we’ve seen computers and cell phones shrink in size while improving reliability and power, fuel cells continue to be refined.

Wind turbine

A wind turbine (essentially a propeller spinning atop an 80- to 100-foot pole) collects kinetic energy from the wind and converts it to electricity for your home. And according to the Department of Energy, a small version can slash your electrical bill by 50 to 90 percent.

But before you get too excited, you need to know that the zoning laws in most urban areas don’t allow wind turbines. They’re too tall. The best prospects for this technology are homes located on at least an acre of land, well outside the city limits.

Green roof

Another way to keep the interior of your house cooler—and save on air-conditioning costs—is to replace your traditional roof with a layer of vegetation (typically hardy groundcovers). This is more expensive than a cool roof and requires regular maintenance, but young, environmentally conscious homeowners are very attracted to the concept.

Hybrid heating

Combining a heat pump with a standard furnace to create what’s known as a “hybrid heating system” can save you somewhere between 15 and 35 percent on your heating and cooling bills.

Unlike a gas or oil furnace, a heat pump doesn’t use any fuel. Instead, the coils inside the unit absorb whatever heat exists naturally in the outside air, and distributes it via the same ductwork used by your furnace. When the outside air temperature gets too cold for the heat pump to work, the system switches over to your traditional furnace.

Geothermal heating

Geothermal heating units are like heat pumps, except instead of absorbing heat from the outside air, they absorb the heat in the soil next to your house via coils buried in the ground. The coils can be buried horizontally or, if you don’t have a wide enough yard, they can be buried vertically. While the installation price of a geothermal system can be several times that of a hybrid, air-sourced system, the cost savings on your energy bills can cover the installation costs in five to 10 years.

Solar power

Solar panels capture light energy from the sun and convert it directly into electricity. Similarly to wind turbines, your geographical location may determine the feasibility of these installments. Even on cloudy days, however, solar panels typically produce 10-25% of their maximum energy output. For decades, you may have seen these panels sitting on sunny rooftops all across America. But it’s only recently that this energy-saving option has become truly affordable.

In 2010, installing a solar system on a typical mid-sized house would have set the homeowner back $30,000. But as of December 2018, the average cost after tax credits for solar panel installation was just $13,188! Plus, some companies are now offering to rent solar panels to homeowners (the company retains ownership of the panels and sells the homeowner access to the power at roughly 10 to 15 percent less than they would pay their local utility).

Solar water heaters

Rooftop solar panels can also be used to heat your home’s water. The Environmental Protection Agency estimates that the average homeowner who makes this switch should see their water bills shrink by 50 to 80 percent.

Tax credits/rebates

Many of the innovative solutions summarized above come with big price tags attached. However, federal, state and local rebates/tax credits can often slash those expenses by as much as 50 percent. So before ruling any of these ideas out, take some time to see which incentives you may qualify for at dsireusa.org and the “tax incentives” pages at Energy.Gov.

Regardless of which option you choose, these technologies will help to conserve valuable resources and reduce your monthly utility expenses. Just as importantly, they will also add resale value that you can leverage whenever you decide it’s time to sell and move on to a new home.

by John Trupin, Windermere

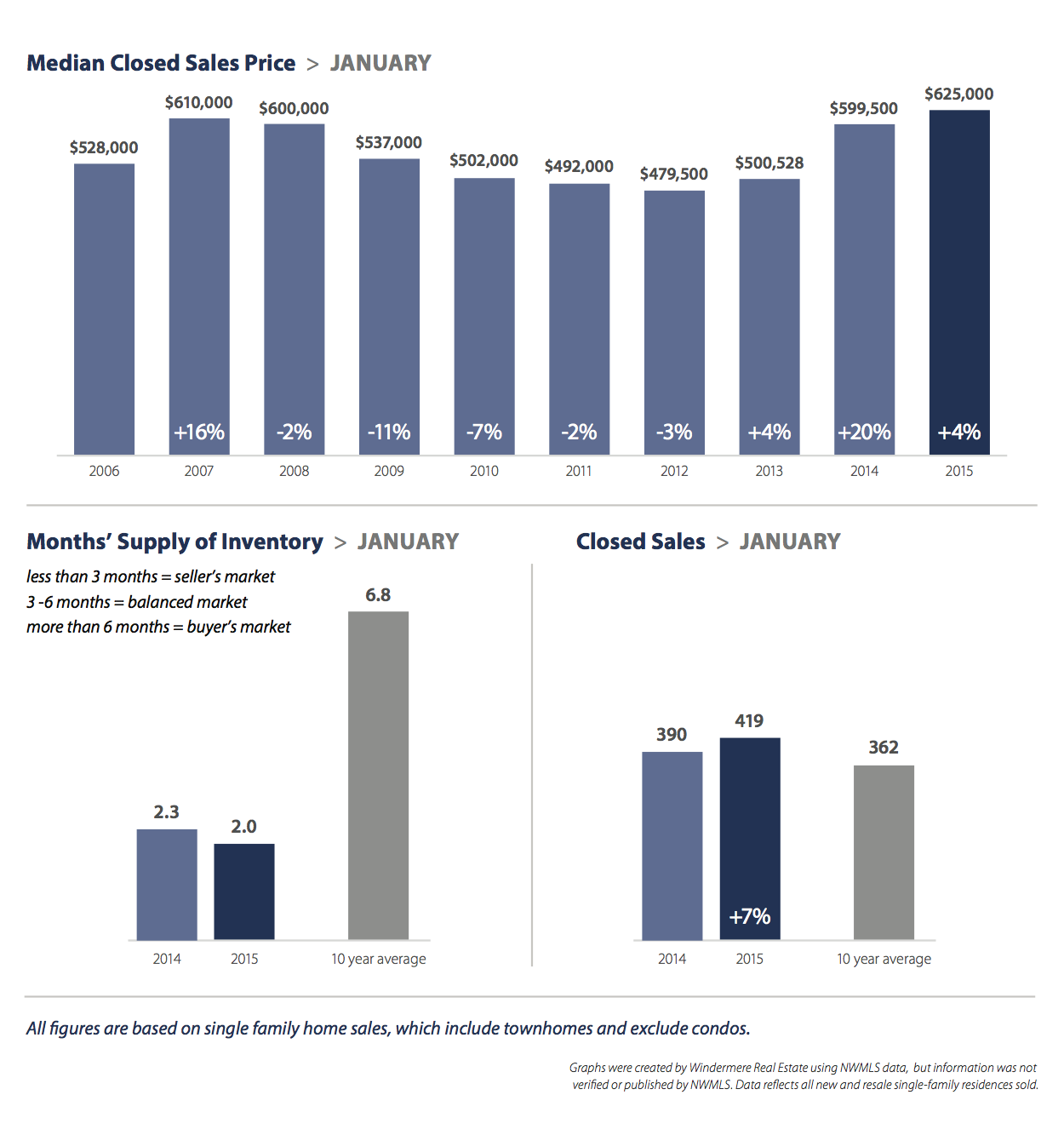

Neighborhood Update – February 2015

The new year started out with a bang. The market saw year-over-year increases in pending sales, closed sales and home prices. Mortgage rates hit a 20 month low. The one cause for concern: inventory is not keeping up with demand.

• The number of closed sales were slightly higher than a year ago, and the number of pending sales (agreements that have been signed but not yet closed) made it the best January in 15 years.

• Home prices throughout King County continued to climb.

• Supply of inventory fell by double digits.

Eastside

High demand and low supply continued to boost home prices on the Eastside. While closed sales were up, pending sales were down. The median price of single family homes sold on the Eastside in January was $625,000, an increase of about 4 percent over last year. Inventory continued to drop to a two month supply. Areas close to the city centers experienced a particular shortage of homes for sale.

Seattle

Seattle continued to have the lowest supply of single family homes in King County. The city averaged 1.3 months of inventory, with northwest Seattle having just three weeks of supply. Low inventory pushed the median price of a single family home there to $517,500 – 13 percent higher than a year ago. The number of closed sales remained unchanged from a year ago, while pending sales were up slightly.

King County

The median price of single family homes sold in King County in January was up nearly 8 percent over last year to $441,500. Inventory continued to be very tight, with just a two month supply available. A supply of three to six months is considered balanced. With more consumers competing for less inventory, buyers should anticipate multiple offers for most new listings.

Read the original post on the Windermere Eastside blog.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link